U.S. leading economic indicators declined 0.1% in September, following a revised-down 0.2% decline in August.

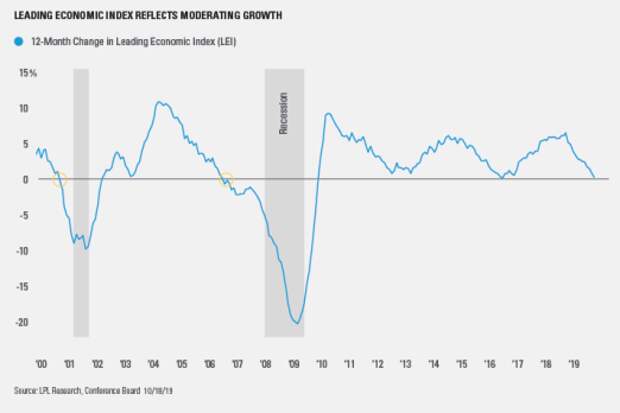

The Conference Board’s Leading Economic Index (LEI) declined month over month, underwhelming Bloomberg estimates of a flat reading. As shown in the LPL Chart of the Day, the LEI climbed 0.4% year over year. This marks a new low since the 2016 downturn.

While the obvious downward trajectory projects a view of deteriorating economic strength, we believe that the story behind the headline number paints a less dire picture. The year-over-year number for the past three months has been heavily influenced by the runoff of strong data from the year prior, as new readings have come in roughly flat for the past 11 months. In this sense, the year-over-year number has been more of a reflection of past economic strength.

September marks the final month of difficult runoffs for the series, so future releases should be more impactful on the year-over-year number. In this sense, subsequent readings should be more reflective of future economic conditions, which we expect will demonstrate some stabilization.

The LEI, which we include as one of the “Five Forecasters” in our Recession Watch Dashboard, has yet to turn negative this cycle. The index has fallen negative year over year before all nine recessions since 1955.

“The most recent LEI release fits with our thesis of moderating economic growth,” said LPL Financial Senior Market Strategist Ryan Detrick. “While the low year-over-year number is sure to raise eyebrows by falling below 1%, we feel confident that the economy can continue to grow, albeit at a slower pace than investors have become accustomed.”

In September, five of ten components rose month over month, but four components—Institute for Supply Management (ISM) new orders, building permits, the interest-rate spread, and average consumer expectations for business conditions— fell month over month. Average weekly manufacturing hours were unchanged in September. Historically, breadth in LEI components has deteriorated further before a recession started, as more than half of the LEI components were in decline at the end of each of the past six economic cycles.

Overall, evidence is plentiful of a slowdown in the manufacturing economy, but we remain encouraged by the resilience of the consumer, and a still-strong services economy.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. The economic forecasts set forth in this material may not develop as predicted.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. All performance referenced is historical and is no guarantee of future results.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (Member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL is not an affiliate of and makes no representation with respect to such entity.

If your advisor is located at a bank or credit union, please note that the bank/credit union is not registered as a broker-dealer or investment advisor. Registered representatives of LPL may also be employees of the bank/credit union. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, the bank/credit union. Securities and insurance offered through LPL or its affiliates are:

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed Not Bank/Credit Union Deposits or Obligations | May Lose Value

For Public Use | Tracking # 1-906614